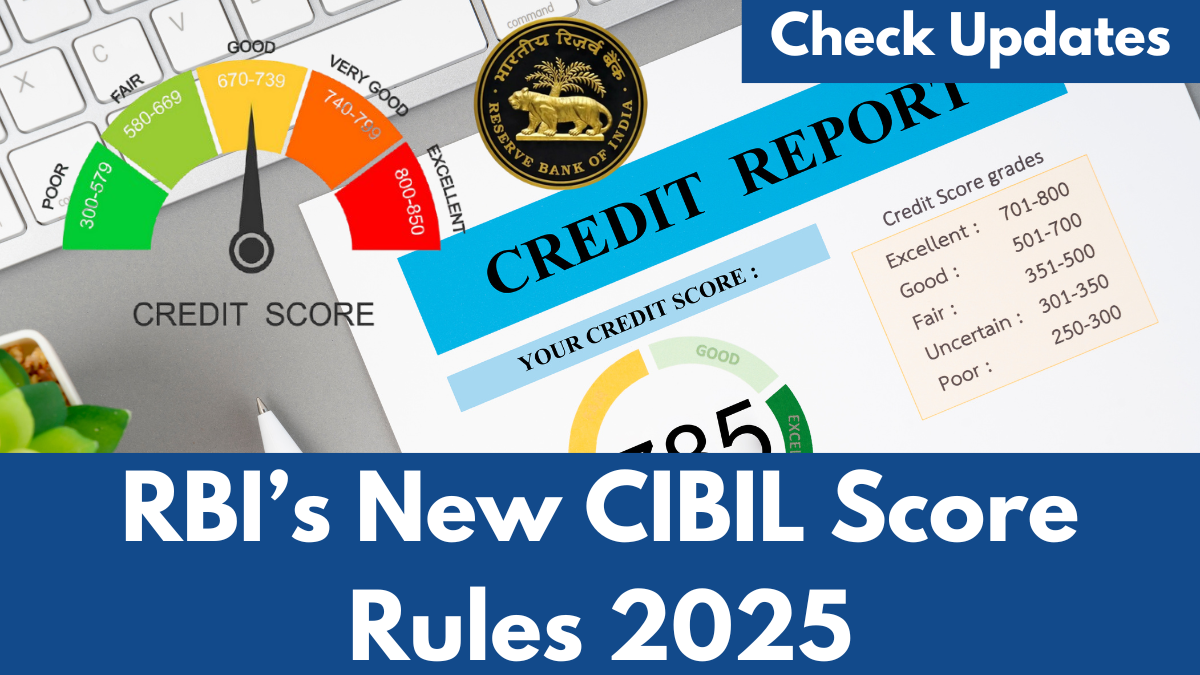

In 2025, the Reserve Bank of India (RBI) implemented a series of robust guidelines to enhance the transparency and efficiency of CIBIL score management. These reforms aim to empower individuals by ensuring quicker updates, prompt notifications, and improved accessibility to their credit history. By understanding these changes, borrowers can make well-informed financial choices and exercise greater control over their credit health. Let’s explore these new regulations and their impact on consumers in greater detail.

What Makes the CIBIL Score Crucial for Financial Health?

A CIBIL score is a numerical representation of an individual’s creditworthiness. It plays a vital role in determining financial opportunities and outcomes.

Also Read: CRPF Recruitment 2025: Multiple Vacancies Across Various Roles

Key Reasons for the Importance of a CIBIL Score:

- Loan Eligibility: A higher CIBIL score increases the chances of loan approvals from banks and financial institutions.

- Lower Interest Rates: Borrowers with excellent credit scores are often rewarded with lower interest rates, leading to significant savings.

- Credit Card Approvals: A strong credit score ensures easy approval for credit cards with better benefits.

- Avoiding Rejections: Poor credit scores can result in rejections for loans and other credit facilities, limiting financial flexibility.

Maintaining a good CIBIL score not only provides better borrowing options but also enhances financial stability in the long run.

RBI’s New Rules for CIBIL Score Updates: A Game-Changer

The RBI’s new guidelines focus on making CIBIL score management more efficient and consumer-friendly. Here’s a detailed look at the key changes:

1. Faster Updates

- Old System: Previously, CIBIL scores were updated only once a month, often leading to delays in reflecting financial activities.

- New Rule: Scores will now be updated every 15 days, ensuring quicker insights into credit behaviour and activities.

This rapid update system allows borrowers to monitor their financial performance in near-real-time.

2. Monthly Information Sharing

- Credit institutions are now required to share consumers’ financial activities with Credit Information Companies (CICs) every month.

- This ensures credit reports are accurate and up-to-date, providing consumers with reliable data to track their financial health.

Enhancing Transparency with Timely Notifications

Transparency and timely communication are at the core of the new RBI guidelines.

Key Notification Features:

- Credit Report Access Alerts: Consumers will receive email or SMS alerts whenever a lender accesses their credit report. This ensures they are aware of who is reviewing their financial information.

- Default Notifications: Borrowers will now receive prior notifications before being labelled as defaulters. These alerts will be sent via email or SMS, offering an opportunity to address repayment issues proactively.

These measures promote trust between borrowers and lenders and encourage consumers to stay informed about their financial status.

The Impact of RBI’s Guidelines on Borrowers

The revised rules bring a host of benefits to borrowers, reflecting the RBI’s commitment to enhancing financial literacy and borrower protection.

1. Faster Credit Monitoring

Regular updates enable borrowers to monitor their credit score changes more effectively, helping them stay on top of their financial situation.

2. Improved Transparency

By keeping consumers informed about their credit activities and history, the new rules build greater trust between lenders and borrowers.

3. Opportunity to Avoid Defaults

The prior notification system ensures borrowers have the chance to address repayment issues before being flagged as defaulters, reducing long-term financial repercussions.

4. Enhanced Financial Management

With timely updates and alerts, borrowers can take proactive measures to improve their credit scores, resulting in better borrowing opportunities and financial health.

Also Read: SJVN Recruitment 2025: 300 Apprenticeship Vacancies – Apply Now

Conclusion

The RBI’s 2025 guidelines for CIBIL score management are a significant step toward enhancing consumer empowerment and financial transparency. By introducing faster updates, timely notifications, and improved data sharing, the RBI aims to protect borrowers’ interests and promote better credit health. Staying informed and proactive under these new rules will help consumers achieve greater financial stability and confidence.

FAQs

1. How frequently will CIBIL scores be updated under the new rules?

CIBIL scores will now be updated every 15 days, as opposed to the previous monthly schedule.

2. What should I do if I receive a notification about a potential default?

Immediately contact your lender to understand the issue and resolve it promptly to avoid being labelled as a defaulter.

3. How can I access my updated credit report?

You can access your credit report directly from Credit Information Companies (CICs) or authorized platforms that provide CIBIL score reports.

4. What are the benefits of prior notifications about credit report access?

These notifications allow consumers to identify when lenders are reviewing their credit information, promoting transparency and awareness.

5. How do these new rules improve financial literacy?

The regular updates and notifications empower borrowers to stay informed about their credit health, enabling them to make better financial decisions.

Click here to learn more.

Vinod is a dedicated writer specializing in education, career, and recruitment topics, delivering clear and actionable insights to empower readers.